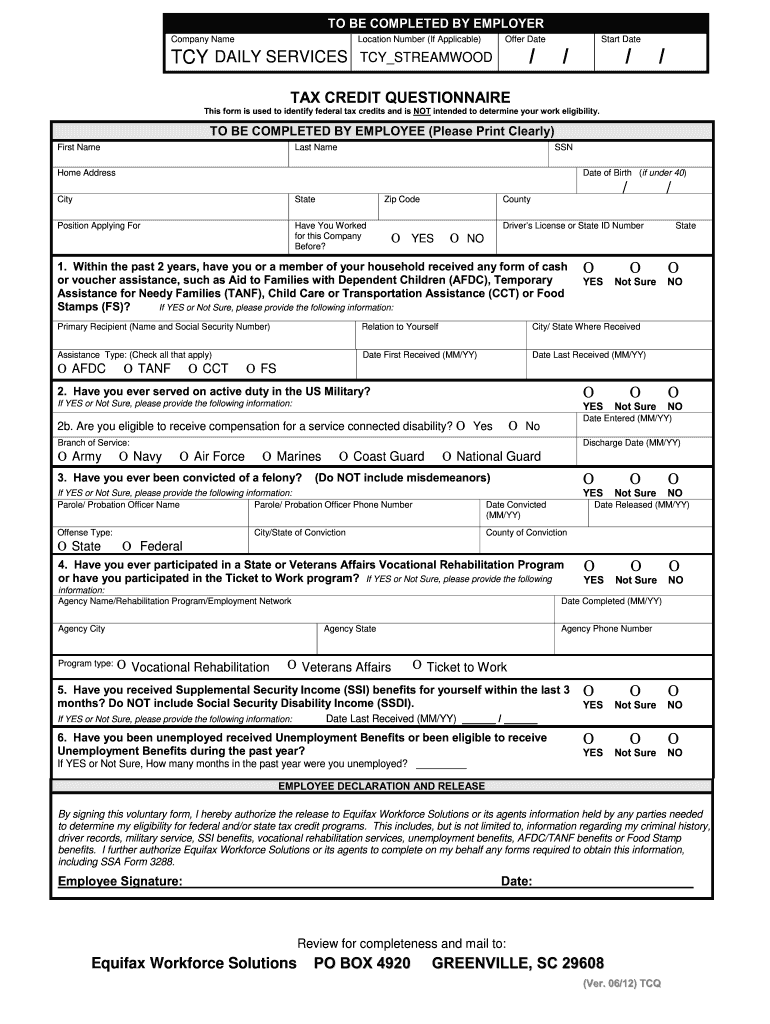

work opportunity tax credit questionnaire form

Check to see if you qualify. Ad Wotc tax credit questionnaire.

Fillable Online Tax Credit Questionnaire Fax Email Print Pdffiller

Create this form in 5 minutes.

. The Work Opportunity Tax Credit program is an incentive for employers to hire new employees from targeted groups of employees. Check Out the Latest Info. Comply with our simple steps to.

Create Legally Binding e-Signatures on Any Device. IRS Form 8850. Ad Create a questionnaire online for free.

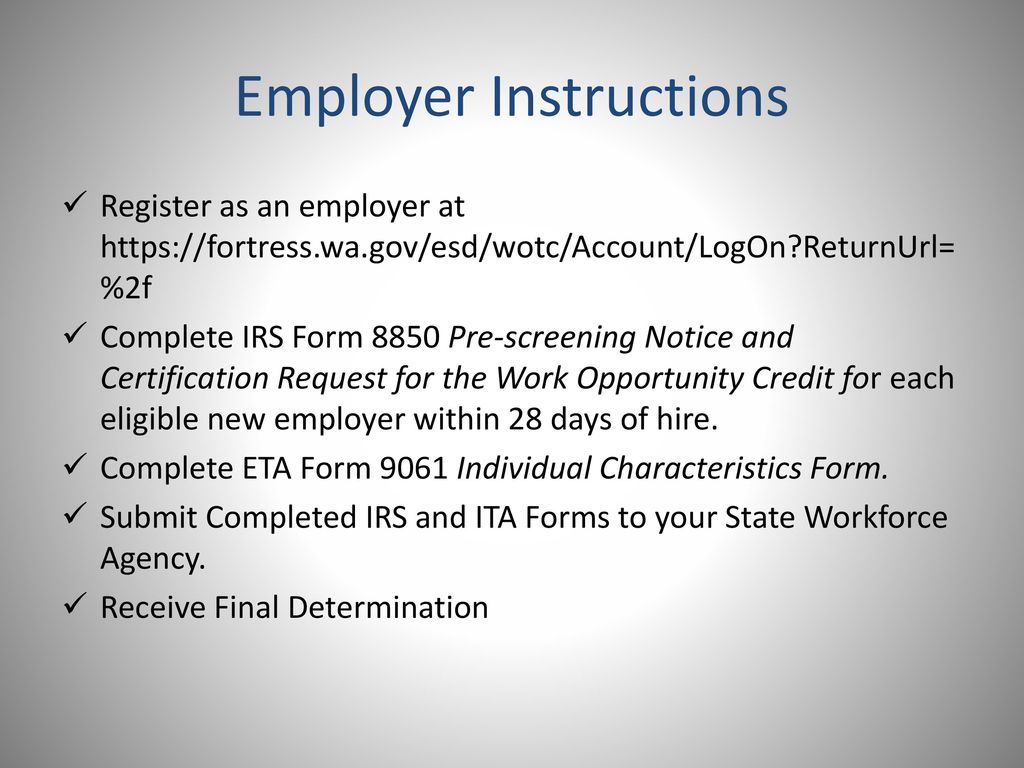

Up to 26000 per employee. A work opportunity tax credit questionnaire helps to find out whether a company is following the Work Opportunity tax credit program as directed by the Federal government. The job seeker or the employer must complete the Individual Characteristics Form Work Opportunity Tax Credit ETA 9061.

WOTC Eligibility Questionnaire The Work Opportunity Tax Credit program WOTC promotes workplace diversity and facilitates access to good jobs for American workers. Use e-Signature Secure Your Files. Upload Modify or Create Forms.

Ad Register and Subscribe Now to work on your WOTC for Tax-Exempt Org Hiring Veterans Form. No limit on funding. Legal Forms with e-Signature solution.

Wotc Tax Credit Questionnaire. Check to see if you qualify. On or before the day that an offer of employment is made the employer and the job applicant must complete Form 8850 Pre-Screening Notice and Certification Request for.

Now creating a Wotc Questionnaire requires at most 5 minutes. Qualified tax-exempt organizations will claim the credit on Form 5884-C Work Opportunity Credit for Qualified Tax-Exempt Organizations Hiring Qualified Veterans as a credit against the employers share of Social Security tax. It is used to determine whether the employee in question is eligible for the WOTC program.

Try it for Free Now. Work opportunity tax credit 2020. ETA Form 9175 Long-Term Unemployment Recipient Self-Attestation Form.

Employers file Form 5884 to claim the work opportunity credit. Work Opportunity Tax Credit Authorization Center. ETA Form 9061 Individual Characteristics Form.

Browse Our Collection and Pick the Best Offers. Information about Form 5884 Work Opportunity Credit including recent updates related forms and instructions on how to file. The Work Opportunity Tax questionnaire is the first page of IRS Form 8850.

The form may be completed on behalf of the applicant by. The Work Opportunity Tax Credit is a voluntary program. As such employers are not obligated to recruit WOTC-eligible applicants and job applicants dont have to complete the.

Use professional pre-built templates to fill in and sign documents online faster. Our state online blanks and complete recommendations eliminate human-prone mistakes. Ad We take the confusion out of ERC funding and specialize in working with small businesses.

When you apply for a new job your employer may ask you to fill out a tax credit questionnaire on IRS Form 8850 Employment Training. State work opportunity tax credit WOTC coordinator for the SWA must certify the job applicant is a member of a targeted group. Hi the Work Opportunity Tax Credit Questionnaire is a questionnaire that employers give to their new hires to determine if they are eligible for a tax credit for hiring.

New hires may be asked to complete the. The credit will not affect the employers Social Security tax liability reported on the organiz See more. Ad We take the confusion out of ERC funding and specialize in working with small businesses.

Help state workforce agencies SWAs determine eligibility for the Work Opportunity Tax Credit WOTC Program. The employer and the job seeker must complete the Pre. ETA Form 9062 Conditional Certification.

ABC COMPANY participates in the federal governments Work Opportunity Tax Credit Welfare to Work and other federal and. Information about Form 8850 Pre-Screening Notice and Certification Request for the Work Opportunity Credit including recent updates related forms and instructions on how to file. Ad TALX Tax Credit Questionnaire More Fillable Forms Register and Subscribe Now.

After starting work the employee must meet the minimum. Get answers actionable insights. Discover why were a leading questionnaire platform around the globe.

Mailed applications will take longer to process. Ad TALX Tax Credit Questionnaire More Fillable Forms Register and Subscribe Now. Up to 26000 per employee.

No limit on funding. April 27 2022 by Erin Forst EA. What is the Work Opportunity Tax Credit.

The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment.

Employment Incentives Work Opportunity Tax Credit

Wotc Questionnaire Fill And Sign Printable Template Online Us Legal Forms

Do I Have To Fill Out Work Opportunity Tax Credit

Work Opportunity Tax Credit U S Department Of Labor

Work Opportunity Tax Credit What Is Wotc Adp

Wotc Calculator Management Tool Equifax Workforce Solutions

Publication 596 2021 Earned Income Credit Eic Internal Revenue Service

Revamping The Federal Ev Tax Credit Could Help Average Car Buyers Combat Record Gasoline Prices International Council On Clean Transportation

How The Work Opportunity Tax Credit Subsidizes Dead End Temp Work Propublica

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Work Opportunity Tax Credit What Is Wotc Adp

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Wotc Questions Is There A Spanish Language Form Available Cost Management Services Work Opportunity Tax Credits Experts

Work Opportunity Tax Credit Wotc Ppt Download

Adp Work Opportunity Tax Credit Wotc Smartrecruiters Marketplace

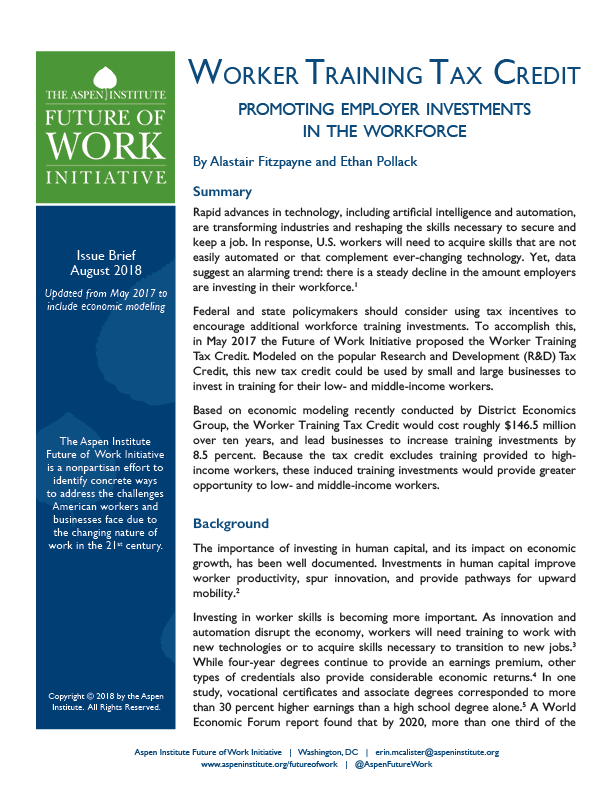

Worker Training Tax Credit Promoting Employer Investments In The Workforce The Aspen Institute

The Top Work Opportunity Tax Credit Questionnaire On Job Application

The Top Work Opportunity Tax Credit Questionnaire On Job Application